[ad_1]

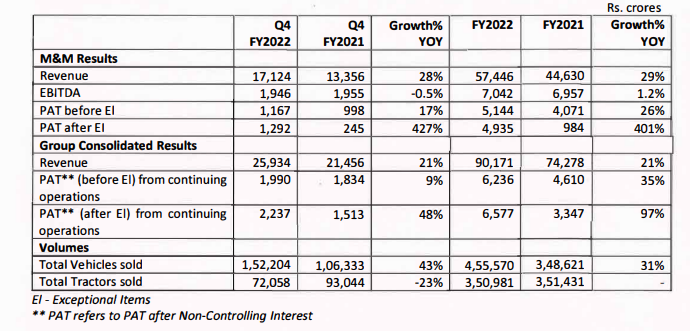

New Delhi: Mahindra & Mahindra (M&M) on Saturday reported a growth of 427% in its standalone profit (after exceptional items) to INR 1,292 crore in the quarter ended March 2022.

The company had reported a PAT of INR 245 crore in the corresponding quarter last fiscal.

Its revenue during Q4 FY22 stood at INR 17,124 crore, marking a growth of 28% from INR 13,356 crore in Q4 FY21.

The company said that its automotive business has over 170,000 overall open bookings and XUV7OO is leading the way with 78,000 open bookings.

Total vehicle sales for the fourth quarter of fiscal 2021-22 were recorded at 152,204 units, as against 106,333 units in Q4 2020-21.

“Semiconductor supplies have improved in Q4 resulting in highest ever Quarterly UV Volumes,” said the company in a statement.

Mahindra clocked total tractor volumes of 72,058 units in Q4 FY22, as compared to 93,044 units in Q4 FY21.

For the fiscal ended March 2022, M&M’s reported a PAT of INR 4,935 crore, marking a growth of 401% over INR 984 crore in FY21.

Revenue during the year stood at INR 57,446 crore, as against INR 44,630 crore reported in FY21.

Dr. Anish Shah, Managing Director & CEO, M&M Ltd said, ” Our performance in Q4 and FY22 underscores the resilience of our business model. Despite significant challenges due to various factors like Covid, Commodity prices, semiconductor shortages and the Ukraine conflict, we have delivered strong results at the consolidated level. All of our group companies are well positioned to capitalize on growth opportunities”.

Rajesh Jejurikar, Executive Director, M&M Ltd, said, “We recorded our highest revenue for Auto and Farm segment in FY22. M&M became No.1 in SUV Revenue Market Share in Q4 and H2 FY22, while FES gained 180 basis points market share in FY22. FES delivered second highest full year PBIT despite market slowdown and steep commodity inflation. Given the recent fiscal and monetary measures by Government of India and RBI, we foresee the cost pressures in the economy to ease out”.

Manoj Bhat, Group Chief Financial Officer, M&M Ltd, said, “Our focus on capital allocation and improved financial metrics continues to deliver results. We continue on our journey towards 18% RoE”.

The company’s board has announced a dividend of INR 11.55 per share.

[ad_2]

Source link