[ad_1]

New Delhi:

Country’s largest carmaker Maruti Suzuki India Limited (MSIL) on Friday reported a 51% growth in its consolidated profit to INR 1875.8 crore in the quarter ended March 31, 2022.The company had reported a profit of INR 1241.1 crore in the corresponding quarter of last fiscal.

Its revenue from operations stood at INR 26749 crore in Q4 FY22 as against INR 24035 crore in Q4 FY21.

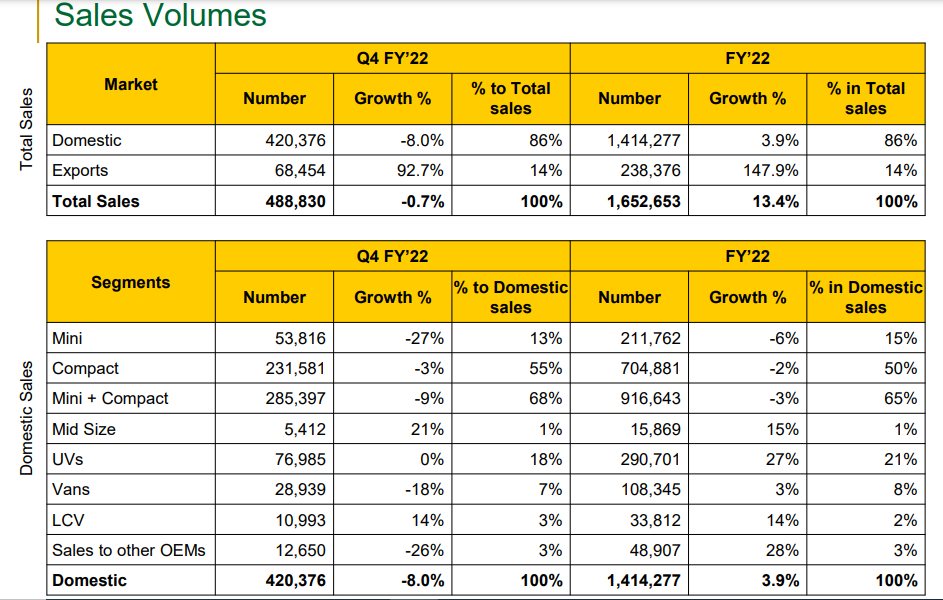

The Company sold a total of 488,830 vehicles during the Quarter, lower by 0.7% compared to the same period previous year. In the Quarter, the sales in the domestic market stood at 420,376 units, a decline of 8% over that in Q4 FY21. The sales in the export market were at 68,454 units which is the highest ever in any Quarter.

Maruti Suzuki said that the key reasons for margin improvement during the quarter include cost reduction efforts, lower sales promotion expenses and increase in selling prices, and higher non-operating income. However, adverse commodity prices served as the negative factor.

For FY22, the company said its consolidated net profit stood at INR 3,879.5 crore as compared to INR 4,389.1 crore in FY21, down 11.6%.

Consolidated total revenue from operations for FY22 was at INR 88,329.8 crore as against INR 70,372 crore in FY21, it added.

“Production during the year was impacted by shortage of electronic components by an estimated 270,000 vehicles, mostly domestic models, because of which there were pending customer bookings of about 268,000 vehicles at the end of the year. In addition, the first quarter witnessed a disruption owing to the second Covid wave,” Maruti Suzuki said.

According to the carmaker, though the profit in FY 2021-22 was lower, the Board of Directors recommended a dividend of INR 60 per share (face value of INR 5 per share) compared to INR 45 per share in FY 2020-21. “This is a special one-time gesture to thank shareholders for their patronage and support as the Company commemorates its 40th year since inception,” it said.

Also Read:

[ad_2]

Source link