[ad_1]

New Delhi:

Truck rentals or freight rates – a composite indicator of economic activity – have risen significantly across key trunk routes in the past one month. An uptick in the movement of goods from FMCG/FMCD, mining applications, parcel goods, textiles, and agri-products led to an increase in freight demand.As crude prices firmed up, truck rentals in April went up by 4%-5% on key truck routes, while diesel prices were up by nearly INR 3.60 per liter, says Indian Foundation for Transport Research & Training (IFTRT).

Trunk route round rates have gone up by INR 7,000- INR 9,000 between April 1, 2022 and May 1, 2022, helped by an increase in factory output and of most bulk goods.

“With the wheat and other cereal harvest picking momentum during April 2022 and at the same time cargo movement from factory gates too went up by 10-20% leading to higher demand for trucks on truck routes leading to jump in truck rentals by 4-5% across the country,” SP Singh, senior fellow at IFTRT, said.

He noted that increase in food items procurement in the rural regions and growth in import export cargo aided the situation. Singh also pointed out higher income and consumer spending due to peak marriage season helped the buoyancy in freight rates.

Main truck routes like Delhi-Mumbai-Delhi are up by 4.8% while Delhi-Hyderabad-Delhi rose by 5%. Others like Delhi-Kolkata-Delhi and Delhi- Chennai-Delhi have increased by 5% respectively, as per the IFTRT data. Truck routes are the main routes in which cargo moves across the country.

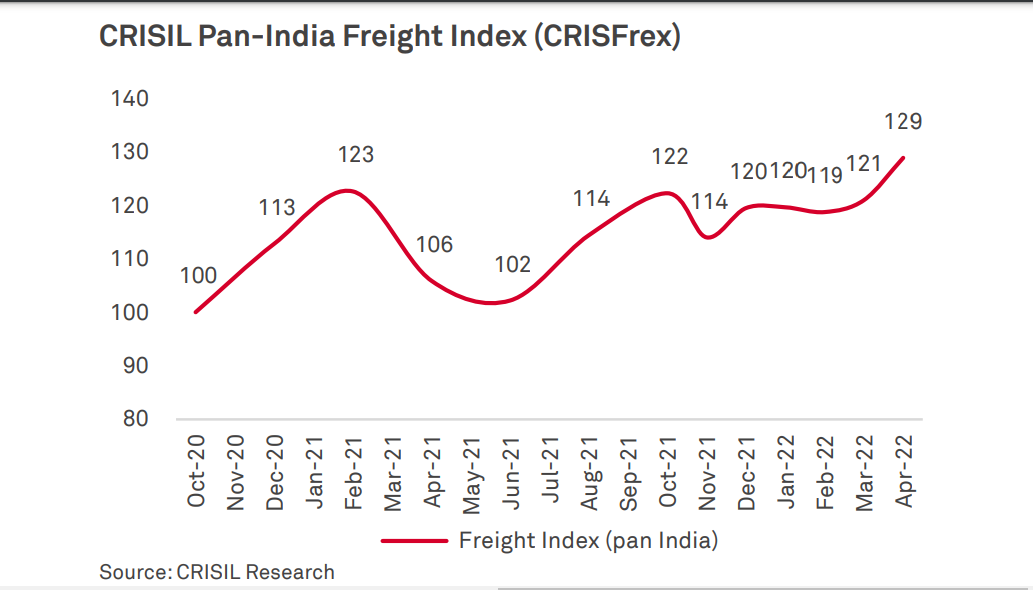

According to the rating agency CRISIL, transporters passed on higher diesel prices by raising freight rates on several routes last month. However, it noted that fleet utilisation was flat on-month. While there was higher utilisation for agri-products, cement, mining (largely coal and iron ore), and parcel/loose goods, this was offset by slightly lower utilisation for auto-carriers, market load, and steel.

“Utilisation remained unchanged for fast moving consumer goods (FMCG)/ fast moving consumer durables (FMCD), containers, textiles, and petroleum tankers. Freight rates for automobile carriers, containers, petroleum tankers, and steel rose in low single digits.” the rating agency noted.

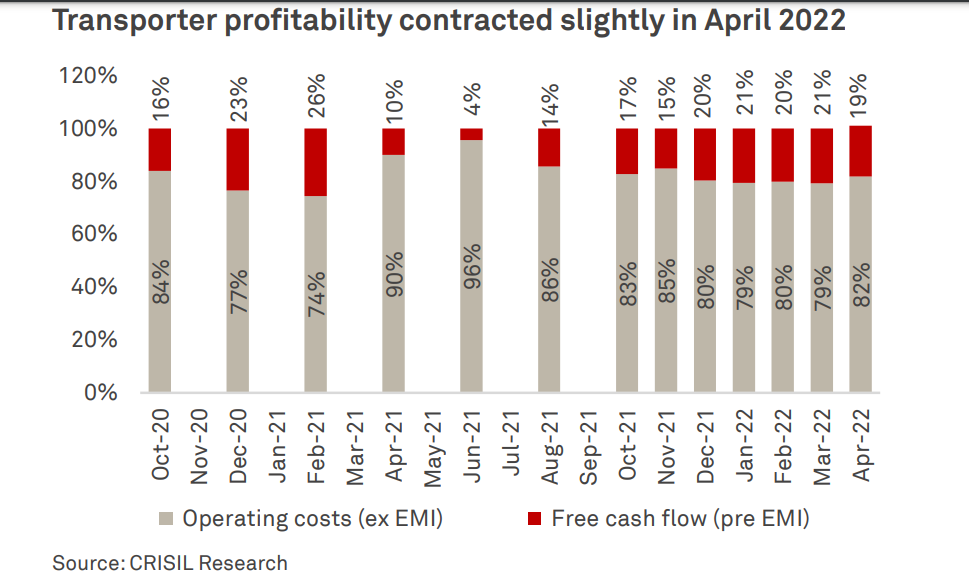

“Raising concern over high fuel prices CRISIL said that free cash flow of transporters declined sequentially by 200 basis points in April. Higher operating cost constrained the ability of transporters to generate higher — or maintain — cash flows compared with last month,” it added.

Also Read:

[ad_2]

Source link